The “Private-Equity Playbook” for Legal Tech

What PE firms typically do once they buy into a legal tech software vendor, why they do it, and where customers can get burned.

Why PE likes Legal Tech

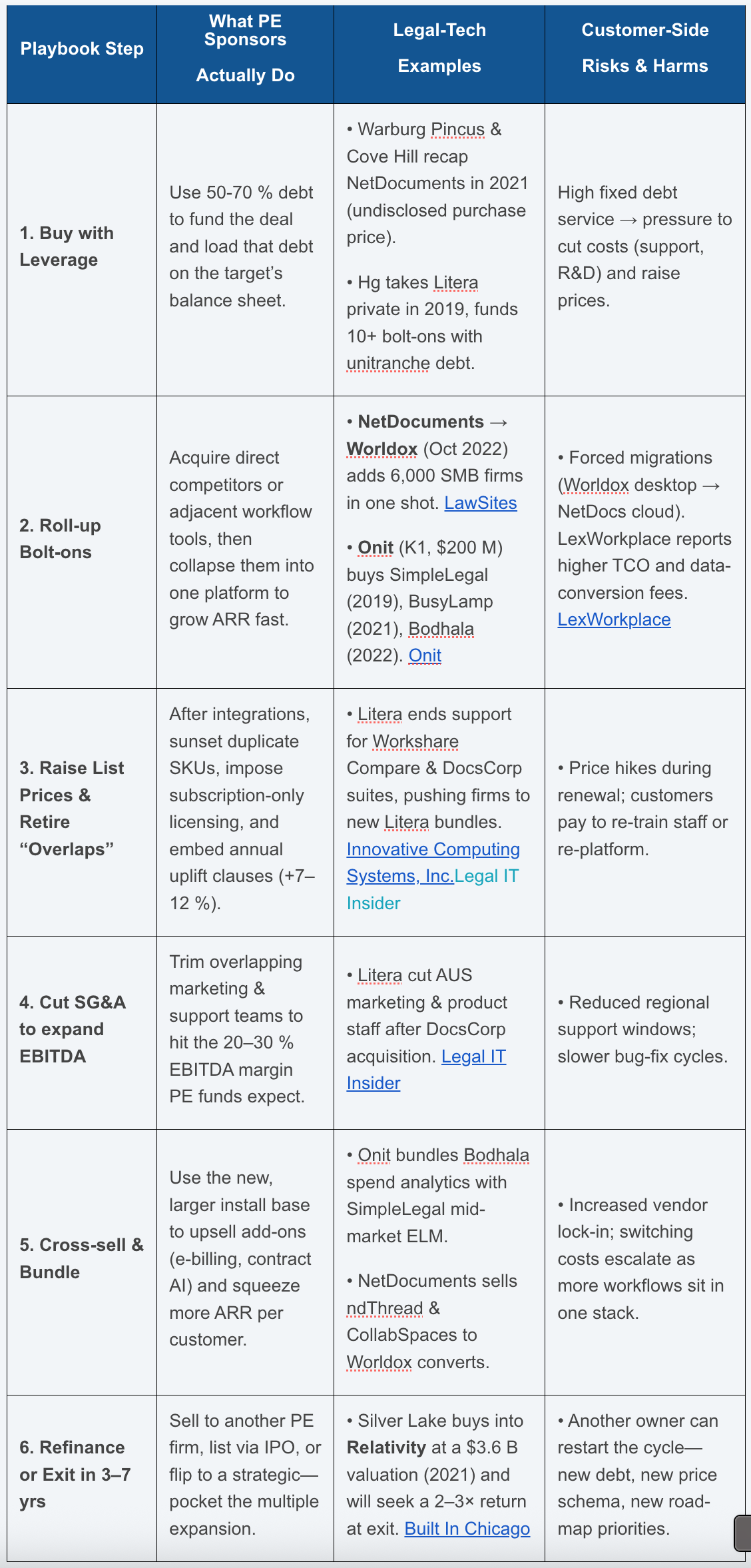

Sticky revenue: Once mission-critical data (contracts, work product) is inside a platform, churn is <5 %.

Highly fragmented market: Easy to bolt-on smaller vendors and create scale economies.

Pricing power: Law-firm & corporate legal budgets are still a small slice of total matter value, giving head-room for increases.

Customer Risks in Detail

Price inflation outpacing value.

Post-deal list prices often jump 8-15 % at the first renewal; some firms report a 40 % TCO hike moving from Worldox to NetDocuments’ cloud LexWorkplaceForced migrations & product sunsets.

Litera’s EOL notices give <24 months before legacy Workshare/DocsCorp tools stop patching security bugs. Innovative Computing Systems, Inc.LiteraSupport degradation.

Lay-offs of regional teams (e.g., Litera Australia) mean slower ticket response and fewer local experts. Legal IT InsiderInnovation stall.

Debt service + EBITDA targets redirect cash from R&D to interest payments, delaying needed features (e.g., Worldox users waited years for modern cloud search).Change-of-control uncertainty.

When Silver Lake exits Relativity, a new owner could split cloud vs. on-prem SKUs or spin-off analytics—customers have no seat at that table.

Mitigation Checklist for Buyers

Key take-away

Investor-owned platforms can deliver real scale and innovation—but the PE playbook (debt, roll-ups, price lifts, support cuts) creates predictable customer pain points. Write strong contract clauses (price caps, change-of-control escape, support SLAs, open-data export) and keep an eye on ownership news so you’re protected before a deal closes.

Add one more lever—look beyond the funded crowd.

Bootstrapped or family-owned vendors such as LEAP (small-firm PMS), Dennemeyer (global IP management), mot-r (legal work orchestration) and long-standing niche tools like Tabs3 often:

price more predictably (no EBITDA targets to hit),

maintain stable road-maps for decades, and

offer direct access to founders for support.

Including at least one “un-funded” alternative in every RFP keeps pressure on PE-backed suppliers—and gives you a fallback if the next roll-up cycle makes your current vendor too expensive or too risky.

Sign up below for mot-r blogs and updates.